About us

We’re here to protect families

Today, only 35% of people have life insurance cover, and when we first launched CLARK UK (formerly Candid) that number was significantly lower. We knew something needed to change, so we started our business with the sole purpose of helping every family get the cover they need.

What sets us apart

Find out why we could be a good partner for your life insurance.

We think families matter

What truly sets us apart is our genuine passion for helping parents, the over 50s, and those in full-time employment. We believe everyone deserves protection from the financial strain that can happen when we lose a loved one, and we are proud to help families across the UK gain that small financial peace of mind.

Honest, tailored straightforward advice

No jargon or industry speak, just open, honest advice on how parents can help financially protect their families. Our advisors bust myths, build connections, and make it easy for our customers to get the right policy for their specific needs.

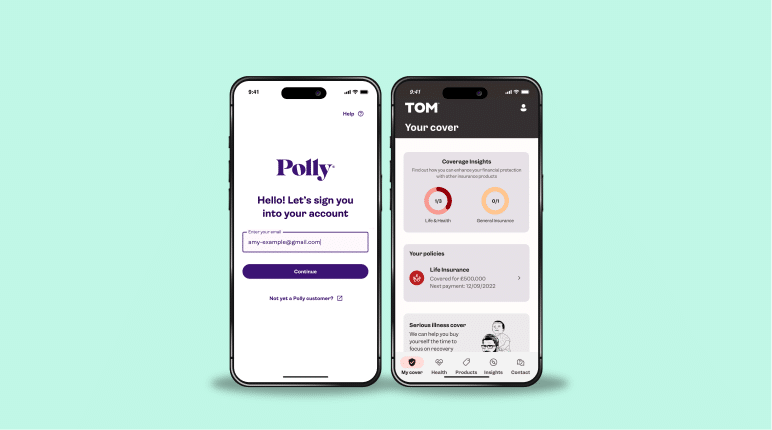

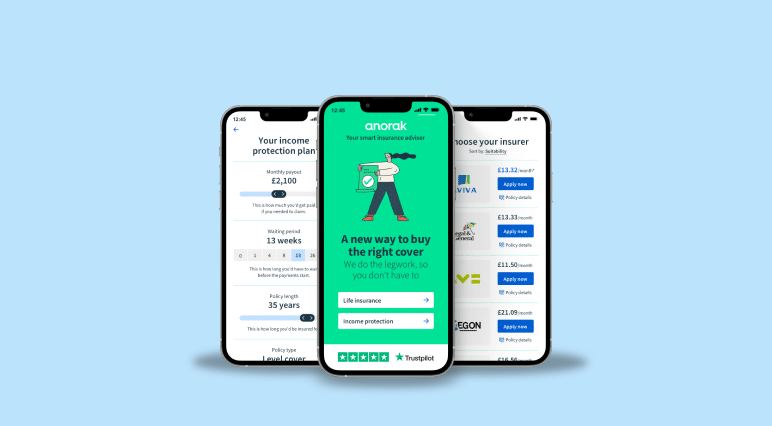

Life insurance for the digital age

Forget the days when policy documents sat in a drawer gathering dust. Inspired by the personal and engaging way “neobanks” interact with customers, we’re bringing insurance into the digital age. Our “Insuretech” approach applies innovation at every stage – from acquiring customers, to delivering products, and beyond. Now, customers can interact with their policy and our advisors via a personalised app, making their insurance more accessible than ever before.

We do things differently

When people tell us something can’t be done, we ask “why not?”. We know that to grow and continue making money for our shareholders, we have to stand apart from everyone else. This challenger mindset is what has driven us to achieve results that many in our industry never thought possible.

Customer experience is crucial

We want to remove the stigma that paying for life insurance is like paying your council tax. Our message is simple: life insurance helps to provide you with some peace of mind if the worst were to happen. Our goal is to educate customers on what they receive as part of that monthly payment, while making the end-to-end process as seamless and pain-free as possible.

Our Journey

Follow our journey that started 2013

It starts with attracting people

By speaking directly to parents, we’ve created a market segment that’s focused enough to enable pinpoint accurate marketing, yet wide enough to offer an almost limitless market. Using emotional triggers, needs identification and great advice, we generate a huge number of prospective new customers from an audience that, typically, had never really thought about life insurance.

Our business model in a nutshell

Our vision of the future

Discover how we want to redefine life insurance

Looking ahead, we want to take life insurance further than simply helping to provide financial peace of mind. We want our customers to have access to real, immediate, tangible benefits. Like the choice to access trusted financial advice from an experienced adviser or via the app.

Easy to understand policies that can be swiftly set up in minutes, digitally or by phone. Appointments with virtual GPs, mental health support and parenting advice, available on your phone at the touch of a button. We’ve already begun this journey, and we’re only just getting started.